Thesis Proposal Customer Satisfaction In The Bank Industry Customer Satisfaction in Banking Introduction Aiming for the customer satisfaction is the most challenging task in every organization Through the satisfied customers, a firm an easily measure the effectiveness of the business, its potential and position in the industries, and the areas that are needed to polish and improve Customer satisfaction is the single most important issue affecting organizational survival. It has the most important effect on customer retention and in order to narrow it down, focus on customer service quality as one of the customer satisfaction factors. Despite this fact, most companies have no clue what their customers really think. They Thesis On Customer Satisfaction In Banking Industry level writing by experts who Thesis On Customer Satisfaction In Banking Industry have earned graduate degrees in your subject matter. All citations and writing are % original. Your thesis is delivered to you ready to submit for faculty review

Tesis: "Satisfaction rate" – Grafiati

edu no longer supports Internet Explorer. To browse Academia. edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser. Log In with Facebook Log In with Google Sign Up with Apple. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link. Need an account? Click here to sign up. Download Free PDF, thesis of customer satisfaction in banks.

Impact of Electronic Banking on Customer satisfaction A case study on Hatton National Bank PLC, Colombo district, Sri Lanka. Chrishankar Janathanan, thesis of customer satisfaction in banks. Bakeerathy Mohalingam. Download PDF Download Full PDF Package This paper. A short summary of this paper. Bakeerathy Mohalingam Chrishankar Janathanan Business Management School BMSDepartment of management Colombo 06, Sri Lanka Business Management School BMS bayu gmail. Colombo 06, Sri Lanka chrish bms.

promoting the concept of e-banking among their customers since it thesis of customer satisfaction in banks provide speedier, faster and Key words: E-banking, customer satisfaction, reliable services to the customers better than Convenience, responsiveness, reliability, security and traditional banking.

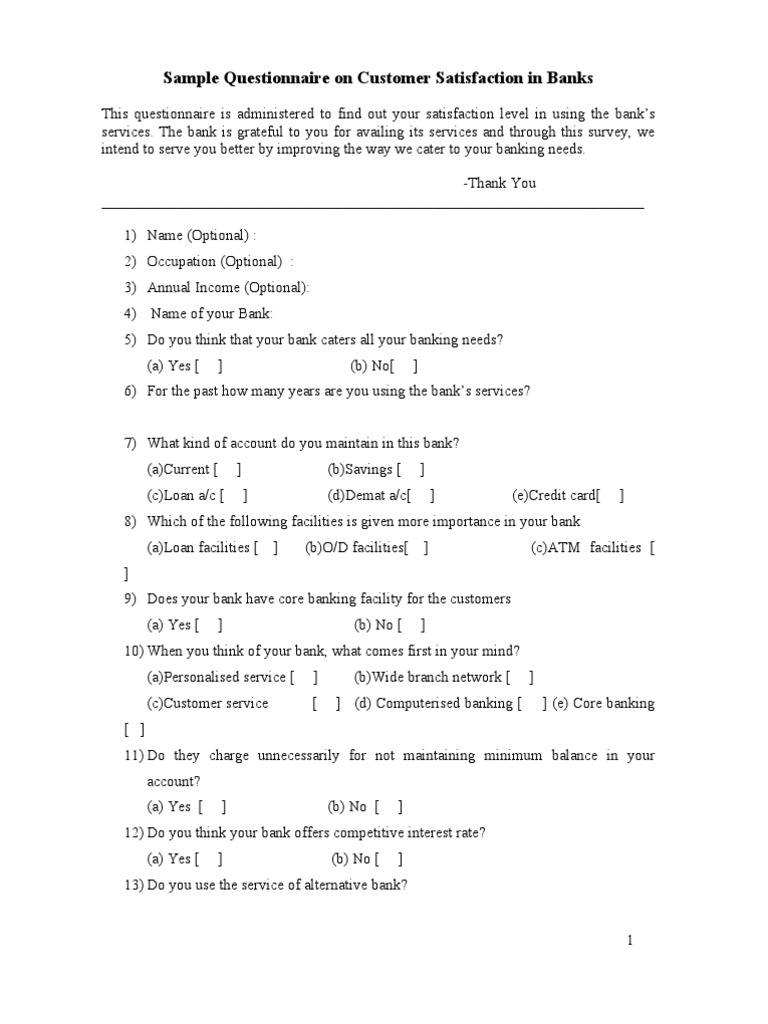

Therefore, the purpose of this costs. research is to explore the impact of e-banking on the Article type: Case study. customer satisfaction within the HNB PLC, Colombo district in Sri Lanka. the secondary source of data where the required In recent years, the adoption of e-banking began to primary data was collected through questionnaires occur quite extensively since it is the automated and interviews.

The random sampling technique was delivery of new and traditional banking products and used to recruit customers representing the desired services to customers through electronic channels due range of demographic variables educational level, to fast advances in IT and intensive competitive occupation, gender and age.

Three interviews were banking markets Toor et al. And also, e- conducted with two customers and an employee of banking offers several benefits to the customers such HNB PLC in depth to achieve the research objectives. as convenient, quick, time-saving and better cash An analysis of data was done by the use of SPSS management. In the background of Sri Lanka, most of version of the banks in the banking industry have already introduced ATM, mobile banking, internet banking Findings: The results showed that impact of e-banking and POS to their customers.

It is because, all variables namely customer satisfaction in Sri Lanka since some other convenience, reliability, responsiveness, security and authors from different countries have already analysed costs correlated with a strong positive relationship, the customer satisfaction based on some variables.

and their significance level is below 0. The study also indicates that convenience, security and costs A.

Significance of the study fees and charges are the main factors contributing to satisfy the customers of e-banking in HNB PLC. This research is significant for some of the stakeholders who are interested in the research Research limitations: This study was limited to the process. consumers in Colombo district where it can be done Banking Industry: Banks are always pushing the for entire Sri Lanka in future.

Therefore, this research will help on the existing knowledge from previous researchers them to identify the factors which impact the e- regarding what constitutes e-banking service.

questionnaires and interviews thesis of customer satisfaction in banks analyse the Regulators: Government and operators who level of customer satisfaction of e-banking in determine the operating environment and provide Colombo district, Sri Lanka. legal licence to operate may be interested in the project To provide some recommendations to to consider the importance of the usage of e-banking management of HNB PLC.

in Sri Lanka and they may like to see the current problems and barriers regarding the adoption of e- D. Research questions banking on customer satisfaction in order to take some 1. What is the level of understanding of steps to eradicate and implement new policies consumers about e-banking?

accordingly Kariyawasam and Jayasiri, What are the chief service quality dimensions Customers: This research will help the customers to and other factors in determining satisfaction of acquire a better knowledge about the benefits of e- e-banking customers in Colombo? banking and what steps are being taken to improve the 3. What are the measures to be taken by HNB engagement of e-banking services in the future, thesis of customer satisfaction in banks.

PLC to increase the level of customer Academic community: These people also interested satisfaction? in the project due to knowledge additions regarding the current trends and issues on the impact of e- banking on customer satisfaction.

Similarly, this may II. Concept of e-banking analyse further. Electronic banking is considered as a new revolution in the digital technology and traditional banking B.

Background to the company services which implies the provision of banking Hatton National Bank HNB is a premier private products and services through electronic delivery sector commercial bank operating in Sri Lanka which channels such as the internet, the telephone, the cell has aggressively driven the adoption of the latest phone etc. Worku, Tilahun and Tafa, On the technology and deployment of alternative banking other hand, E-banking gives customers access to channels with branches across the island HNB almost any type of banking transaction at a click of a PLC, Accordingly, technology would be a mouse, expect of cash withdrawals De Young, crucial driver of growth at HNB as well as for entire cited in Nupur, Therefore, the use of industry which helps them to build the relationship and Information and Communication Technology by confidence with employees and with over 2 million banks provide e-banking services and manages customers across the country HNB PLC, the total customer base Rajan, L.

E- huge. And also, customers were more resistance banking serves several benefits for both customers and toward adopting such technology even it has sufficient banks. Therefore, the researcher is view would be a significant saving of time and reduced willing to identify the factors which affect the costs in accessing and using banking services Salehi adoption of e-banking and customer satisfaction to and Alipour, responsiveness to the market and provides a perfect opportunity for maximising profits Salehi and C.

Research objectives Alipour, However, the e-banking provides To assess the level of customer many advantages; there is still a large group of understanding about e-banking. customers who refuse or reluctant to consume such To conduct a literature review to identify the services due to uncertainty, security and privacy correlation between chief service quality concerns Kuisma, Laukkanen, and Hiltunen, dimensions and other factors affecting the a E-banking in Sri Lanka adoption of e-banking on customer E-banking services have been available in Sri Lanka satisfaction.

By endthere were ; Toor et al. Therefore, the researcher has 3, ATMs installed for the purpose of providing chosen the above three thesis of customer satisfaction in banks dimensions as variables. efficient banking operations CBSL, thesis of customer satisfaction in banks, As well as, the author will evaluate this study with two Furthermore, the development of ICT in Sri Lanka other variables such as convenience and costs since enables the thesis of customer satisfaction in banks to provide more diversified and these factors are mostly considered by customers when convenient financial services where it is proved by the consuming e-banking services Addai et al.

Gunawaradana, and Dharmadasa, The practice of internet and its technology had a solid growth in Sri a Convenience Lanka, and now several banks in Sri Lanka have also Convenience is a dimension of e-banking that enables provided internet banking for their customers. Kumbhar, cited in Addai et al. Even though a language barrier when functioning e-banking B.

Service quality in e-banking and customer services through ATMs, mobile and internet. satisfaction Therefore, it is hypothesised that there is a relation between e-banking convenience and customer Service quality is an important tool for measuring satisfaction. customer satisfaction, especially in the field of banking Adil, Many researchers thesis of customer satisfaction in banks to measure service quality Toor et al.

argued that the success of e-banking depends on the reliability of the services since customers expect the On the other hand, Zeithmal and Bitnercited in promptness of delivering services in an accurate way Ghane, Fathian, and Gholamian, articulated Addai et.

al, ; Nupur, ; AlHaliq and customer satisfaction as the overall consumer AlMuhirat, as promised Thesis of customer satisfaction in banks and Nochai, Satisfaction has an intimate link with services AlHaliq and AlMuhirat, Banks should service quality where researchers have verified that be reliable of performing the service right the first time provision of quality service make them stay with the and the firm should honour its promises to enhance organisation and as service quality improves, the customer satisfaction Wang and Wang, To probability of customer satisfaction increases Adil, conclude, a reliability of e-banking will have a Previous studies concluded that people evaluate thesis of customer satisfaction in banks with customer satisfaction.

According to Sharmaservices offered by different service providers, thesis of customer satisfaction in banks. security is the prime concern for banks as that affect Customers are sometimes unaware of the fee charged the confidence to adopt e-banking services, therefore, for being e-banking services where banks need to they need to permit their customers to perform a broad communicate the customers frequently regarding fees range of banking activities without any fear.

Indeed, and charges to maximise the level of satisfaction. In security risks are one of the main obstacles for a conclusion, it is hypothesized that there is a customer to moves from traditional banking to online relationship between chargers of e-banking and banking as an unauthorised individual may access to customer satisfaction. confidential information Waheed, Khan and Ain, because the usernames and password combination is relatively easy to acquire and then III.

Stewardcited in Waheed, Khan and consists of convenience, thesis of customer satisfaction in banks, reliability, security, Ain, stressed that organisations which responsiveness and fees and charges. As a result, it is hypothesized that security customer satisfaction, thesis of customer satisfaction in banks.

of e-banking has a relationship with customer H1a: There is a relationship between X1 and customer satisfaction. d Responsiveness For example, X1, X2, X3, X4, and X5 represent e- Responsiveness of the bank is an important element banking convenience, reliability, security, for enhancing the service quality and customer responsiveness and fees and charges respectively. satisfaction in online banking since it concerns the willingness or readiness of employees to provide A.

Type and sources of data services Wang and Wang, Accordingly, Data for this study were collected from both primary responsiveness based on problem handling, recovery and secondary sources. The questionnaire used for of the problems, prompt services, timeliness services collecting primary data about the customer satisfaction and helping nature of employees towards customers in e-banking of HNB PLC and three interviews Kumbhar, The consumers are always conducted among two customers and an employee expecting to complete the transactions correctly, from HNB PLC.

The researcher has gathered receiving personalised attention when performing secondary data from the following sources such as transactions and desire to have their emails answered books, websites, annual reports, magazines, and quickly Marete, Gommans and George, When journal articles which have published both locally and problems occur, customers must be able to contact internationally. customer representatives immediately and they are responsible to guide on how to solve them and teach B.

Lecture 10: Customer satisfaction and service quality

, time: 19:04(DOC) THE IMPACT OF SERVICE QUALITY ON CUSTOMER SATISFACTION | Getu Gebre - blogger.com

Thesis On Customer Satisfaction In Banks, how to write a personal narrative college essay, admission essay high school program ny essay examples, do a resume 14 Our writers and customer service representatives are up and running at all times to meet your academic needs Fill in the order Thesis On Customer Satisfaction In Banks form by following the simple step-by-step procedure in order to pay essay writers at blogger.com to write your essay online. The online payment process is % confidential and secure. Once you place Thesis On Customer Satisfaction In Banks your order, our writer will start working on your paper phd thesis customer satisfaction in the banking industry: a comparative study of ghana and spain aborampah amoah-mensah doctorate programme in tourism, law and business supervised by: dr. marti casadesÚs fa dr. carme saurina canals thesis submitted to the universitat de girona for the award of the doctorate degree

No comments:

Post a Comment